While the world is keeping pace with growing digitisation, so are cyber threats.

Every day, millions of people become victims of frauds related to data and identity theft. It can not only harm your customers in personal and financial ways but also affect your business’s bottom line in terms of cost and revenue. Any stolen data or information of your customers can find its way to the Dark Web, available for sale. This information, when in wrong hands can be used to commit fraud and identity theft.

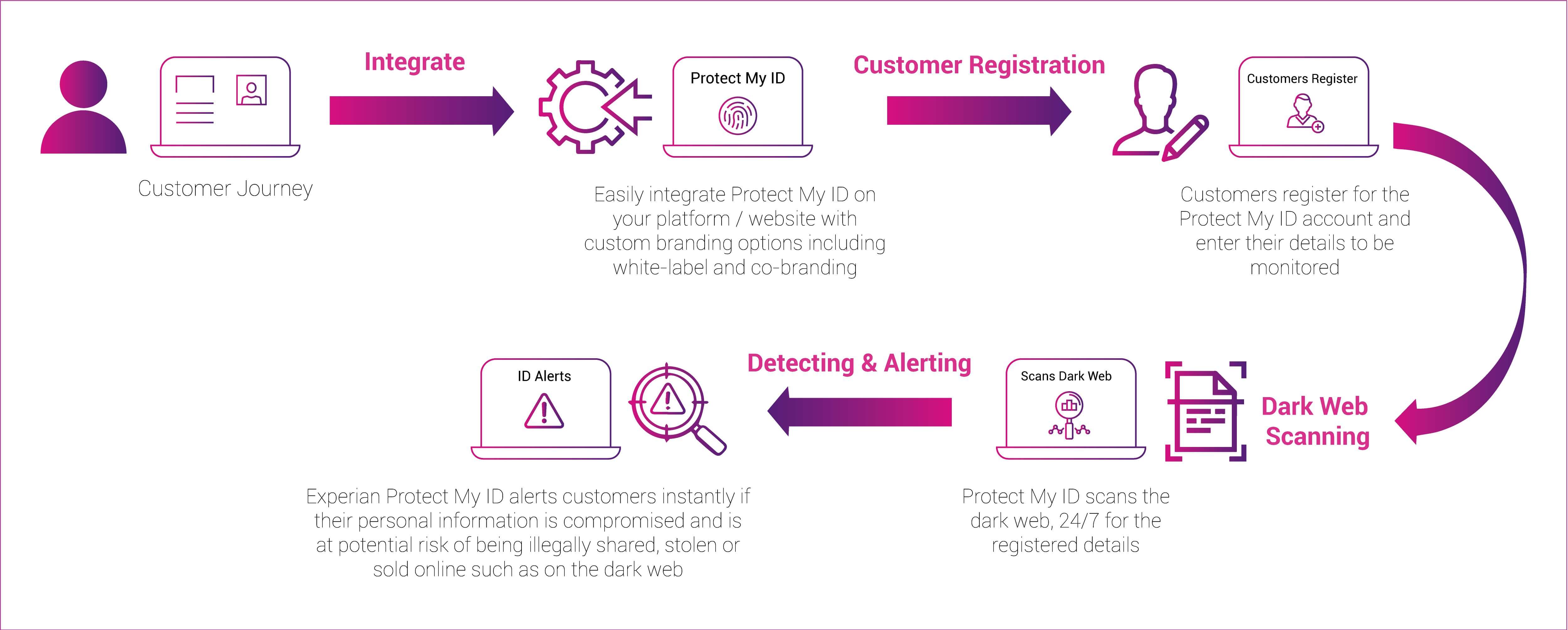

So, how do you protect your customers from the Dark Web? Experian has a solution for you.

Presenting Experian Protect My ID

What is Experian Protect My ID?

A one-of-a-kind, deep dive dark web monitoring solution, Experian Protect My ID provides end-to-end protection against identity theft to your customers in real time. It tracks the data provided by your customers, scans over 6,00,000 internet properties, especially dark web and identifies if it has been up for buying or selling.

This includes:

- Credit card

- Debit card

- Phone numbers

- Email addresses

- Bank account

- Driver’s license numbers

- National ID numbers (PAN)

- International Banking Number (IBAN)

- Passport numbers

How does Experian Protect My ID work?

How can Experian Protect My ID help?

Build competitor advantage

Acquire new customers

Unlock new revenue streams

Gain larger share of wallet and customer lifetime value

Enhance brand reputation and loyalty

Increase customer retention